Change To Home Office Exemption 2022

Change To Home Office Exemption 2022

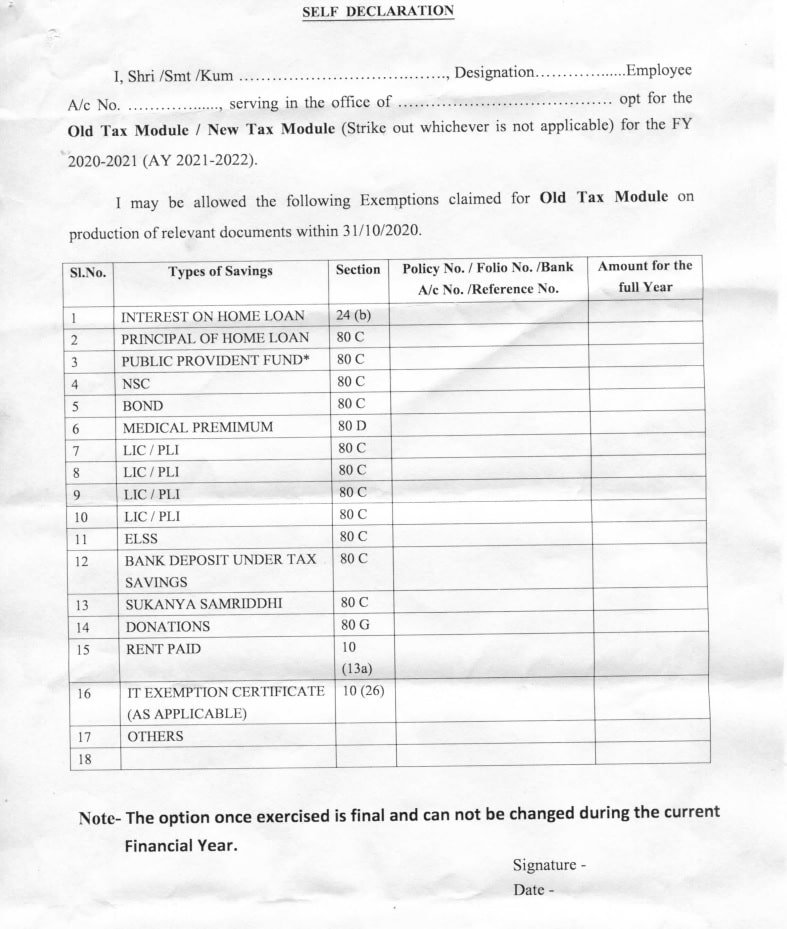

A Actual HRA Received. Home office equipment is equipment necessary for the employee to work from home as a result of the Coronavirus pandemic. An existing tax exemption under section 316 of the Income Tax Earnings and Pensions Act 2003 ITEPA03 applies where an employer provides home office equipment directly and retains. HB 1312 increases this exemption from 7 700 to 50000 for tax years beginning on January 1 2021 and January 1 2022.

Source: https://www.basunivesh.com/latest-income-tax-slab-rates-for-fy-2021-22-budget-2021/

Here are some things to help taxpayers understand the. Deducting Home Office Expenses Journal Of Accountancy. Individual Salaried Employee. Exemption shall be available for journey performed by a shortest route and by prescribed mode of transportations in prescribed situations.

The exemption is adjusted for inflation thereafter.

Source: https://www.basunivesh.com/latest-income-tax-slab-rates-for-fy-2021-22-budget-2021/

Source: https://www.basunivesh.com/latest-income-tax-slab-rates-for-fy-2021-22-budget-2021/Change To Home Office Exemption 2022. 1013A Rule 2A Least of the following is exempt. An existing tax exemption under. Only the necessary things in a conspicuous place good lighting harmony between the color of the furniture and the surrounding space comfortable and functional pieces of furniture to maintain a comfortable working atmosphere.

Conveyance Allowance granted to. Exemption for employer reimbursed home office expenses-- The temporary income tax and national insurance contributions exemption for employer reimbursed expenses for home office equipment necessary to work from home during the coronavirus pandemic will be extended to 5 April 2022. These Regulations amend the Income Tax Exemption for Coronavirus Related Home Office Expenses Regulations 2020 to extend the exemption from income tax for amounts reimbursed to an employee for expenses that the employee has incurred in obtaining home office equipment to enable home working necessitated by the coronavirus outbreak.

Source: https://taxguru.in/income-tax/tds-rate-chart-fy-2021-2022-ay-2022-2023.html

In particular we will extend to see a lot of pampas grasses and white and cream flowers. Did Tax Reform Change The Deductions For Your Home Office The Official Blog Of. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. The exemption can be availed for two journeys in a block of 4 calendar years.

Source: https://taxguru.in/income-tax/section-wise-details-deduction-income-tax-act1961.html

The Act increases the exemption for business personal property tax from 7700 to 50000 for tax years beginning Jan. In terms of wall decorations line art and graphic animations will be both very present trends. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. 1 2021 and Jan.

Source: https://www.relakhs.com/income-tax-slab-rates-for-fy-2021-22/

2021 2022 Home Office Tax Deductions Cpa Practice Advisor. IRS Tax Tip 2020-98 August 6 2020. The timely filing period for Homestead Exemption for 2022 is March 2 2021 through March 1 2022. There is an exemption from property tax for business personal property that is less than a certain amount which increases with inflation.

Source: https://www.relakhs.com/income-tax-deductions-list-fy-2020-21/

If you receive a homestead exemption you may be eligible for additional exemptions or discounts. The state is required to reimburse local governments for the lost revenue as a result of the increased exemption. Stat does not allow late filing for exemptions after this date regardless of any good cause reason for missing the late filing deadline. The interior of a home office 2022 for a woman should demonstrate the excellent taste of its owner.

Source: https://www.relakhs.com/income-tax-slab-rates-for-fy-2021-22/

Conveyance Allowance granted to. Limited to amount actually spent and subject to maximum limits as specified. The current Income Tax and National Insurance contributions exemption for employer reimbursed exp enses that cover the cost of relevant home-office equipment has been extended to 5 April 2022. The Home Office Deduction Using The Simplified Method Taxslayer Pro S Blog For Professional Tax Preparers.

Source: https://7thpaycommissionnews.in/new-income-tax-regime-declaration-form-2020-21-pdf-download/

This measure will extend the end date of the current exemption from the end of the tax year 2020 to 2021 to the end of the tax year 2021 to 2022. The tax exemption provided for by those. Only the necessary things in a conspicuous place good lighting harmony between the color of the furniture and the surrounding space comfortable and functional pieces of furniture to maintain a comfortable working atmosphere. It is a good chance to benefit from the tax incentive as the 150000 threshold will reduce from 30 June 2022.

Source: https://www.indiatvnews.com/business/news-budget-2021-home-loan-interest-deduction-extended-till-march-2022-nirmala-sitharaman-announcement-681907

1013A House Rent Allowance Sec. A change in exemption status does not necessarily mean that your taxes will increase. 1013A Rule 2A Least of the following is exempt. Please call or email our office so we can help you understand your options.

Source: https://economictimes.indiatimes.com/wealth/tax/tax-on-pf-interest-pan-aadhaar-non-linking-fine-other-money-rules-that-change-from-april-1/articleshow/81759692.cms

To qualify for the exemption the office equipment must have been purchased for the sole purpose of enabling the employee to work from home as a result of. In a written statement Jesse Norman The Financial Secretary to the Treasury confirmed that the measure is being legislated. If you are an employee and are working from your backyard home office work-related expenses may be claimed to reduce your income tax. The way this trend fits into our space may change over the seasons.

Source: https://home.kpmg/xx/en/home/insights/2020/03/flash-alert-covid19.html

Exemption for employer reimbursed home office expenses-- The temporary income tax and national insurance contributions exemption for employer reimbursed expenses for home office equipment necessary to work from home during the coronavirus pandemic will be extended to 5 April 2022. For tax years beginning on January 1 2023 the amount of the exemption will. Tax deductions for employees. Work-related expenses include the cost of using equipment and utilities.

Post a Comment for "Change To Home Office Exemption 2022"