Business Use Of Home 2022 Changes

Business Use Of Home 2022 Changes

You may deduct direct business expenses in full and may allocate the indirect total expenses of the home to the percentage of the home floor space used for business. Follow the forms instructions and you end up with the total allowable expenses for the business use of your home. See the Instructions for the Worksheet To Figure the Deduction for Business Use of Your Home later in this publication or the Instructions for Form 8829 for more information about figuring and deducting the business part of these otherwise allowable expenses. A Direct expenses b.

Source: https://time-tips.com/home-based-business-ideas-in-india-2021-2022/

Now lets switch gears and cover claiming a home office deduction when you work for yourself. Over the years the labor force has undergone massive transformations and it continues to do so to meet the needs of both employers and employees. Any loss from the trade or business not derived from the business use of your home. Search the worlds information including webpages images videos and more.

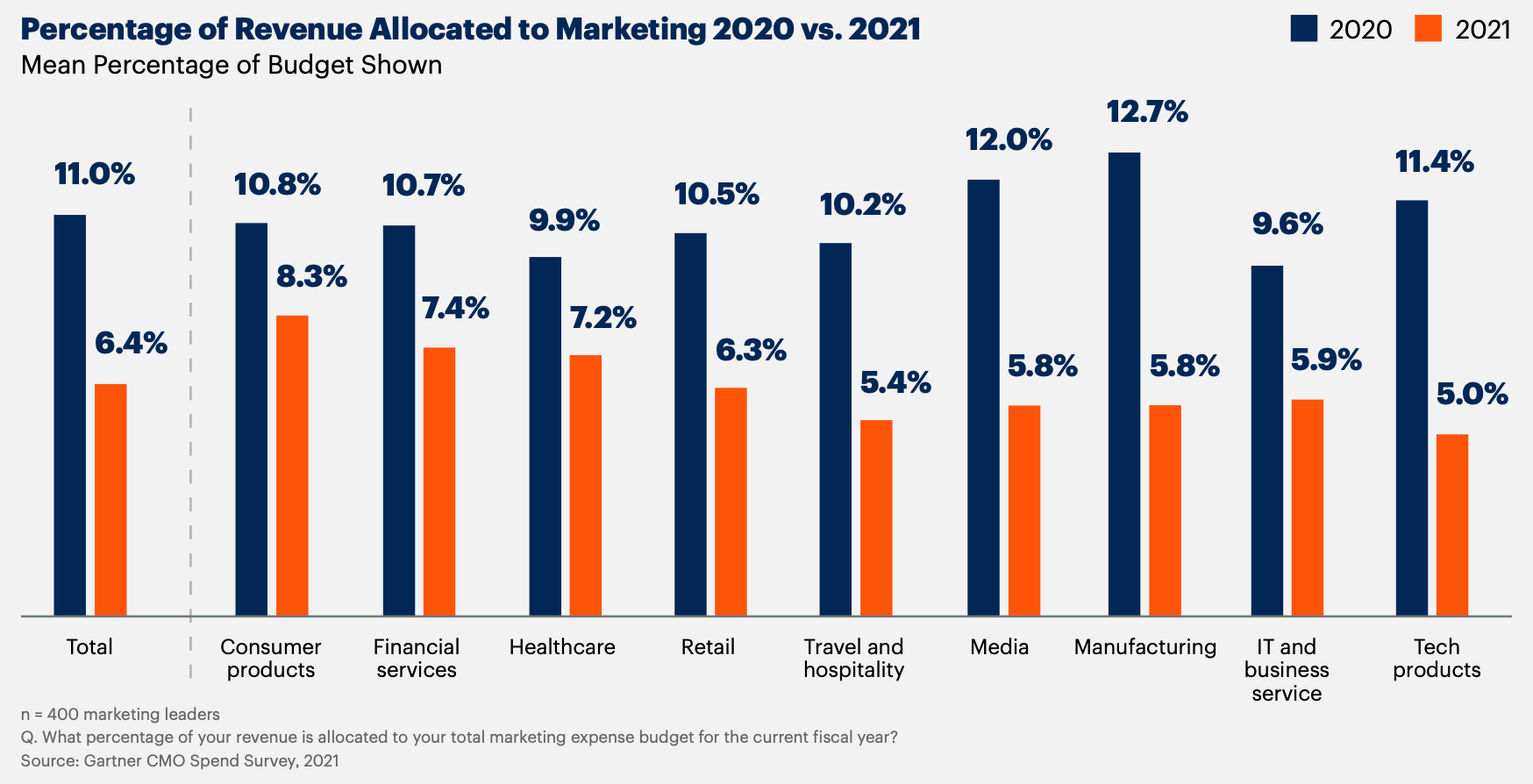

Nine HR trends emerge as the lasting result of workforce and workplace changes resulting from coronavirus pandemic disruption according to a Gartner survey of 800-plus HR leaders.

Source: https://time-tips.com/home-based-business-ideas-in-india-2021-2022/

Source: https://time-tips.com/home-based-business-ideas-in-india-2021-2022/

Business Use Of Home 2022 Changes. Is available for simple tax returns only. These include deferring focus and investment in operations and. The latest forecasts show that the sale of standalone devices will grow from nearly zero in 2017 to more than half of the total AR and VR devices market in 2022 29 million units.

Offer may change or end at any time without notice. Any gain derived from the business use of your home minus. Tethered headsets which require a connection with a computer smartphone or gaming console for use will stay around for a while selling 18 million units in 2022.

Source: https://blog.benchmarkcorporate.com/growing-business-trends-for-2021-2022

Any gain derived from the business use of your home minus. Part IV Carryover of Unallowed Expenses to 2022. Regular Method – You compute the business use of home deduction by dividing expenses of operating the home between personal and business use. The good news is that if youre self-employed or run a business from home tax reform didnt change your ability to deduct home office expenses against your business income.

Source: https://www.smartinsights.com/digital-marketing-strategy/digital-marketing-trends-innovation/

A qualified daycare provider who. Subtract line 27 from line 26. Economic changes and automation of business processes. A new tax reality.

.jpg?width=1200&name=Growing_Business_Trends_For_2021-2022_Social(2).jpg)

Source: https://blog.benchmarkcorporate.com/growing-business-trends-for-2021-2022

Google has many special features to help you find exactly what youre looking for. TurboTax Live TurboTax Live Full Service or with PLUS. C Annual Exclusions. Offer may change or end at any time without notice.

Source: https://realmuloodi.co.ug/real-estate-business-income-tax-act-2021-2022/

Currently there is a 15000 per donor per donee annual exclusion or 30000 per donee annual exclusion for two spouses which exclusion amount increases in future years by inflation adjustments. 16 Latest Employment Trends. See instructions for columns a and b before completing lines 922. These include deferring focus and investment in operations and.

Source: https://twitter.com/BusinessGovNL/status/1443983297030283264/photo/1

Enable business units to customize performance management because what one part of the enterprise needs might not work elsewhere. For more information about deducting real estate taxes see Pub. A new tax reality Budget 2021 Turning data and knowledge into value across your organisation Harnessing the power of technology and unlocking the value residing in a companys data will require a businesss tax function to understand and manage its role accordingly. In the past the idea of working from home was mostly.

Source: https://americanlifestylemag.com/real-estate/buying-selling/your-2022-homebuying-game-plan/

The latest forecasts show that the sale of standalone devices will grow from nearly zero in 2017 to more than half of the total AR and VR devices market in 2022 29 million units. How Businesses Can Use the Home Office Tax Deduction. 20212022 Issues Statistics Predictions. A business shall not be required to comply with subdivision a if the business allows consumers to opt out of the sale or sharing of their personal information and to limit the use of their sensitive personal information through an opt-out preference signal sent with the consumers consent by a platform technology or mechanism based on technical specifications set forth in regulations.

Source: https://www.cnbc.com/2021/07/30/companies-are-already-pushing-their-return-to-office-plans-to-2022.html

The expected effective date for any changes to tax rates or to estate and gift tax exemption amounts is expected to be January 1 2022. With the world changing so rapidly there is a. Tethered headsets which require a connection with a computer smartphone or gaming console for use will stay around for a while selling 18 million units in 2022. The 1 trillion per-year global market for IT service providers is projected to grow by more than 6 percent per year in 2021 and 2022 more quickly than global GDP.

Source: https://www.techrepublic.com/article/windows-server-2022-these-are-the-big-changes-that-microsoft-has-planned/

Direct-to-consumer and e-commerce companies need to avoid five common pitfalls that hamper growth and long-term success. Beginning in 2022 the additional income that would be subject to SECA tax would be the lesser of i the potential SECA income and ii the excess over 400000 of the sum of the potential SECA income wage income subject to FICA under current law and 9235 of self-employment income subject to SECA tax under current law. Actual prices are determined at the time of print or e-file and are subject to change without notice. Is available for simple tax returns only.

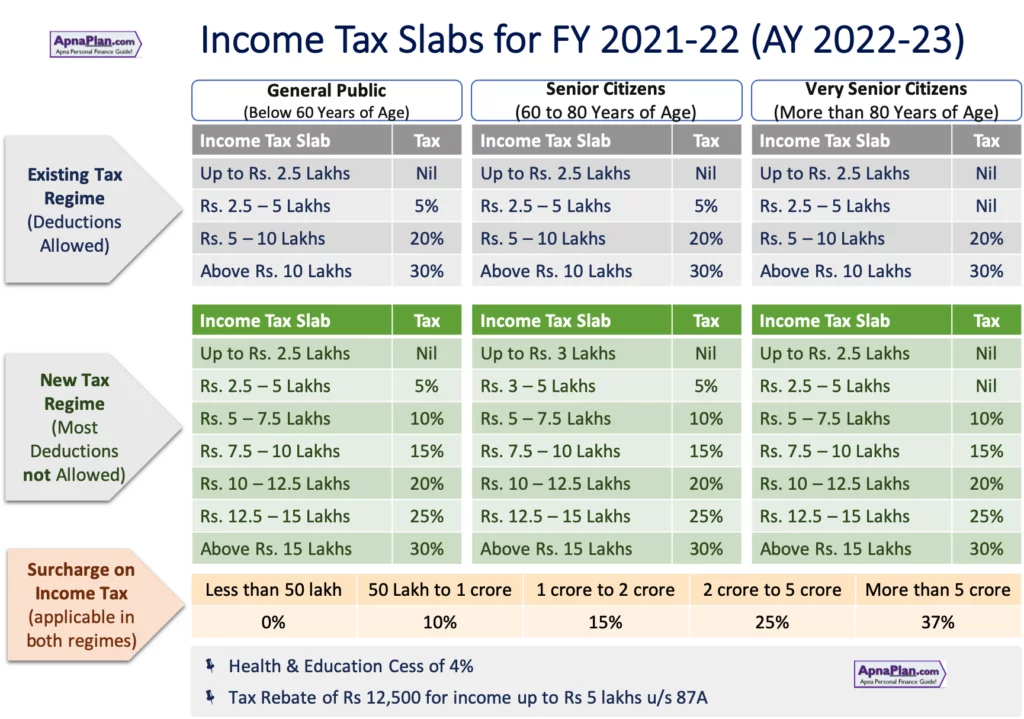

Source: https://www.apnaplan.com/income-tax-calculator-india/

530 Tax Information for Homeowners. 2 South Africa. Gain access to top HR priorities for.

Post a Comment for "Business Use Of Home 2022 Changes"