Business Use Of Home 2022

Business Use Of Home 2022

Asked when the enhanced tax. You cannot deduct any of these expenses. You can even use Craigslist or Facebook Marketplace. Whichever method you choose youll need to claim your use of home as office allowance in the self-employment section of your tax return.

Source: https://time-tips.com/home-based-business-ideas-in-india-2021-2022/

Here Are 5 Best Embroidery Machine for Home Business 2022 1. Standard 5 per square foot used to determine home business deduction. More businesses to use digital technologies by 2022 By 2022 70 of organizations will be using digital technologies for their business processes and improve their customer experience employee productivity and resilience Nicholas Ma president at Huawei Asia-Pacific Enterprise Business Group said at the virtual Philippine Digital Convention PH Digicon 2021 citing. By 2022 70 of organizations will be using digital technologies for their business processes and improve their customer experience employee productivity and resilience Nicholas Ma president at Huawei Asia-Pacific Enterprise Business Group said at the virtual Philippine Digital Convention PH Digicon 2021 citing the global forecast of the International Data Corp.

Net absorption of commercial real estate office space stood at about 20 msf in 2020 more than halved from the previous year as Covid-19 forced employees to.

Source: https://time-tips.com/home-based-business-ideas-in-india-2021-2022/

Source: https://time-tips.com/home-based-business-ideas-in-india-2021-2022/

Business Use Of Home 2022. 7 Part II Figure Your Allowable Deduction. Net absorption of office space may go up to 268 million square foot msf in 2022 ICICI Securities in a recent note to its clients said compared with 185 msf expected in this year. Enter the amount from Schedule C line 29 plus.

The simplified method is an alternative to calculating and substantiating these expenses. Written by Arthur Zuckerman May 31. Enter Business Use of Home on the dotted line beside the entry.

11 Current Business Trends. If your business turnover is less than 85000 for 20212022 youll have the option to fill in the simplified version of this part of the tax return so only need to enter your total expenses. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week – you will not need to keep evidence of your extra costs. The simplified method is an alternative to calculating and substantiating these expenses.

Source: https://www.businesswire.com/news/home/20181212005579/en/Global-Online-On-demand-Home-Services-Market-2018-2022-52-CAGR-Projection-Over-the-Next-Five-Years-Technavio

Enter Business Use of Home on the dotted line beside the entry. Youll need to include your home office claim in the figure you enter. You can start small with your own home-based businesssites like Poshmark and Mercari are great places to sell your unwanted clothing. Regular Method – You compute the business use of home deduction by dividing expenses of operating the home between personal and business use.

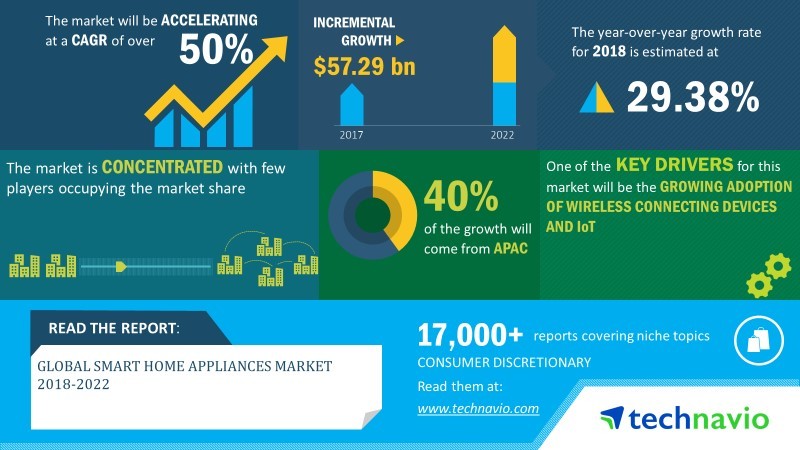

Source: https://www.businesswire.com/news/home/20191212005703/en/Global-Smart-Home-Appliances-Market-2018-2022-50-CAGR-Projection-Through-2022-Technavio

Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes. All others enter the amount from line 3. And while this is an example of easy home business ideas that didnt exactly start from a homeit was a college dorm roomit has since grown into a brand with a loyal following and celebrity fans. THIS DOWNLOAD PRODUCT IS NON-RETURNABLE AND NON-REFUNDABLE.

Source: https://www.businesstoday.in/personal-finance/real-estate/story/bt-insight-planning-to-buy-your-first-home-use-extension-to-get-subsidy-under-clss-259507-2020-05-28

The carryover will be subject to next years deduction limit. Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business. If these expenses exceed the deduction limit carry the excess over to the next year. Using the simplified method to figure your deduction.

Source: https://financialfox.in/best-small-business-ideas-2022.html

You can either claim tax relief on. Finance Minister Paschal Donohoe said on Tuesday that those working from home will be able to claim 30pc on vouched electricity and heating bills instead. Why experts say the shipping crisis wont end until 2022at the earliest Low attendance. By Arthur Zuckerman May 31 2020.

Source: https://time-tips.com/high-profitable-online-digital-business-ideas/

THIS SPECIAL SALE EXPIRES 11182021. Written by Arthur Zuckerman May 31. A qualified daycare provider who doesnt use his or her home exclusively. Any gain derived from the business use of your home.

Source: https://www.businesswire.com/news/home/20180611006140/en/Global-Tiny-Homes-Market-2018-2022-Rising-Number-of-Retirement-Home-Parks-Drives-Growth-Technavio

7 Part II Figure Your Allowable Deduction. Net absorption of office space may go up to 268 million square foot msf in 2022 ICICI Securities in a recent note to its clients said compared with 185 msf expected in this year. If you rent your home you can deduct the part of the rent and any expenses you incur that relate to the workspace. You may deduct direct business expenses in full and may allocate the indirect total expenses of the home to the percentage of the home floor space used for business.

Source: https://keytechnologies.com.au/comms/9-small-business-marketing-trends-to-follow-in-2022/

Enter the amount from Schedule C line 29 plus. In fact markets registered a 27 increase in sales. For daycare facilities not used exclusively for business multiply line 6 by line 3 enter the result as a percentage. The capital gain and recapture rules will apply if you deduct CCA on the business use part of your home and you later sell your home.

Source: https://www.amazon.in/Making-Business-Startup-2021-2022-Step-ebook/dp/B08RRXRNRL

20212022 Data Insights Predictions. Home MasterCook 2022 Download — Business Use License Pre-Release Sale Save 35 MasterCook 2022 Download — Business Use License Pre-Release Sale Save 35 This product is a license for business use. Why experts say the shipping crisis wont end until 2022at the earliest. How much you can claim.

Post a Comment for "Business Use Of Home 2022"