I Paid My 2022 Home Property Tax In 2017. Can I Deduct It From 2017 Return

I Paid My 2022 Home Property Tax In 2017. Can I Deduct It From 2017 Return

Whether a taxpayer is allowed a deduction for the prepayment of state or local real property taxes in 2017 depends on whether the taxpayer makes the payment in 2017 and the real property taxes are assessed prior to 2018. Local Property Tax due in 2022 will apply to properties that have been built since the last valuation date of 1 May 2013. The tax must be paid every year. Please raise a ticket under Grievance for chargeback queries.

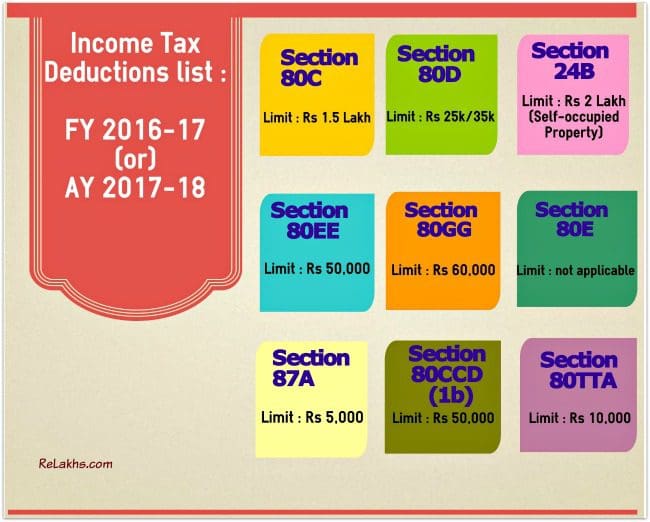

Source: https://www.relakhs.com/income-tax-deductions-fy-2016-17-ay-2017-18-tax-exemptions-benefits-rebates/

If you choose the ADI option the payment will not be deducted from your bank account until 21 March 2022. 24800 for 2020 25100 for tax year 2021. Standard deduction rates are as follows. How you spend your HELOC money affects its deductibility.

After that the maximum deduction is scheduled to revert to 50 percent of.

Source: https://www.relakhs.com/income-tax-deductions-fy-2016-17-ay-2017-18-tax-exemptions-benefits-rebates/

Source: https://www.relakhs.com/income-tax-deductions-fy-2016-17-ay-2017-18-tax-exemptions-benefits-rebates/

I Paid My 2022 Home Property Tax In 2017. Can I Deduct It From 2017 Return. Its from the 2017 Tax Cuts and Jobs Act and is effective for tax years 2018 through 2028. Can I deduct this amount with my 2017 tax return since I have already paid it in 2017 along with the full 2016 property tax amount I paid in 2017. This includes property taxes you pay starting from the date you purchase the property.

If you submit your LPT Return using the paper Form LPT1. The total deduction allowed on your federal tax return for SALT is limited to 10000 per year. Property tax is.

Source: https://www.relakhs.com/income-tax-deductions-fy-2016-17-ay-2017-18-tax-exemptions-benefits-rebates/

SELF ASSESSMENT OF PROPERTY TAX FORM RETURN FORM FOR THE BLOCK PERIOD IN RESPECT OF TAXPAYERS WHO HAVE FILED RETURNS IN THE PREVIOUS YEAR IN FORM I PROPERTY WITH PID NUMBER OR FORM II PROPERTY WITHOUT PID BUT HAVE A KHATHA NUMBER OR FORM III PROPERTY THAT HAVE NO PID OR KHATHA BUT A REVENUE. In the 2019-20 tax year you can claim 25 of your mortgage tax relief. Where to Report Personal Property on Your Taxes Claim the itemized deduction on Schedule A State and local personal property taxes Line 5c. In the 2017-18 tax year you can claim 75 of your mortgage tax relief.

Source: https://www.relakhs.com/understanding-tax-implications-of-income-from-house-property/

The only exception is that beginning with tax year 2018. The total deduction allowed on your federal tax return for SALT is limited to 10000 per year. In the 2018-19 tax year you can claim 50 of your mortgage tax relief. Can I deduct 2018 property taxes on my 2017 tax return.

Source: https://taxguru.in/income-tax/section-wise-details-deduction-income-tax-act1961.html

The temporary exemption for pyrite damaged properties in certain areas will be phased out. Some properties that were previously exempt for example houses built after 2013 are liable for 2022 LPT. Yes you can deduct the property taxes shown on your closing statement for selling your home on your 2017 return. Property tax is.

Source: https://www.relakhs.com/income-tax-deductions-list-fy-2020-21/

BBMP is not responsible for any double excess payments. You can deduct property tax payments that you make directly to the taxing authority as well as payments made into an escrow account that are included in your mortgage payments. Can I deduct this amount with my 2017 tax return since I have already paid it in 2017 along with the full 2016 property tax amount I paid in 2017. With the new income tax laws I would prefer to deduct it with the 2017 tax return.

Source: https://mwcpa.com/tax/rentalrealestate/

Read about how to pay your LPT. Under the 2017 tax law donors who itemize can deduct cash donations of up to 60 percent of their income through 2025. Heres more info to help you. The exemptions for first-time buyers who purchased property between 1 January 2013 and 31 December 2013 and the exemptions for homes in ghost estates will lapse.

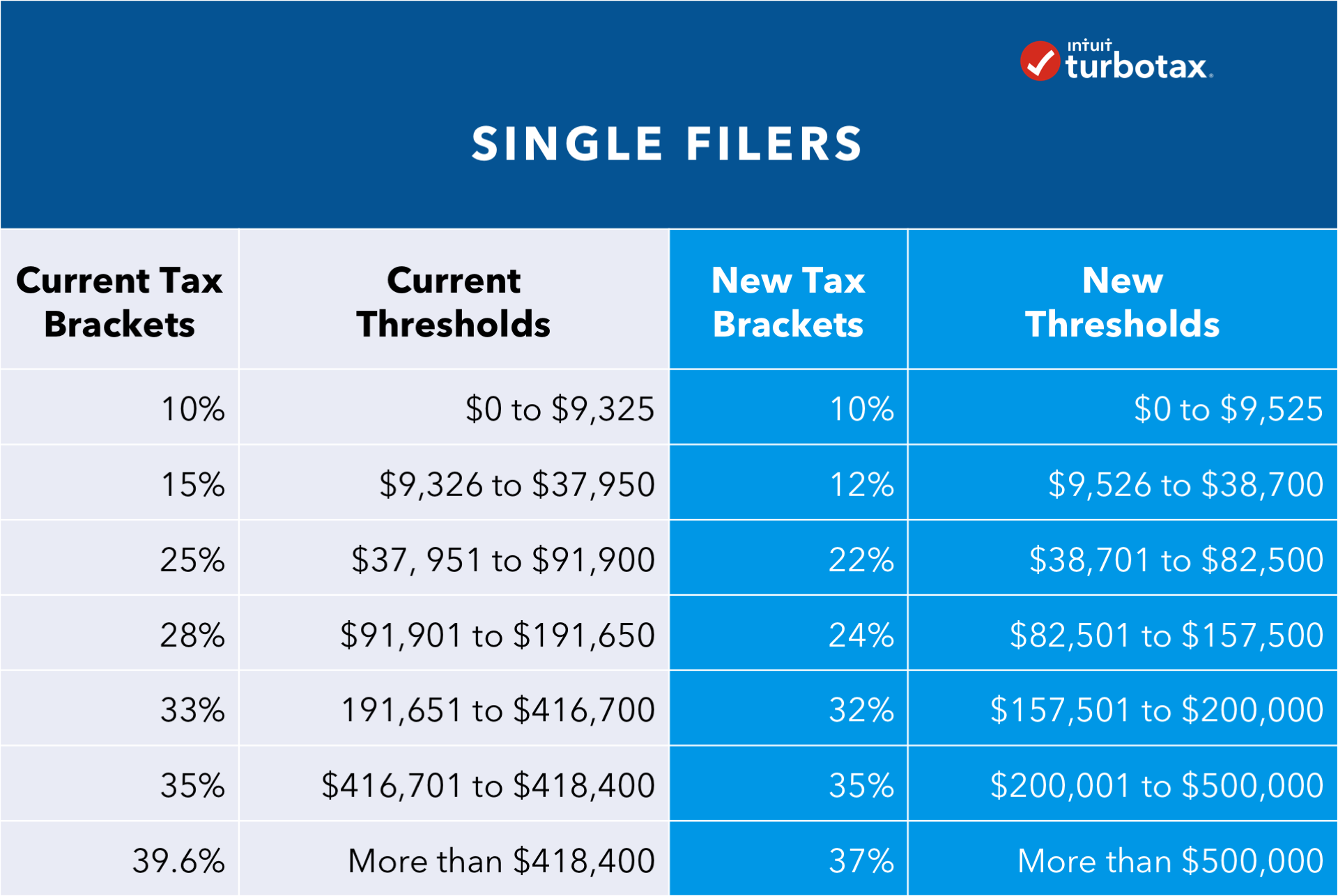

Source: https://turbotax.intuit.com/tax-tips/irs-tax-return/2017-tax-reform-legislation-what-you-should-know/L96aFuPhc

Even if you own an exempt property you must still make a Local Property Tax return to claim an exemption. Homeowners who itemize their tax returns can deduct property taxes they pay on their main residence and any other real estate they own. You can choose to make one single payment or you can phase your payments in equal instalments. Arranging your payment using your paper LPT Return.

Source: https://www.hindustantimes.com/business/income-tax-returns-payments-and-investments-that-will-help-salaried-employees-claim-tax-deductions-101626515229944.html

The official sale date is typically listed on the settlement statement you get at closing. A prepayment of anticipated. This includes property taxes you pay starting from the date you purchase the property. The IRS reminds taxpayers that a number of provisions remain available this week that could affect 2017 tax bills.

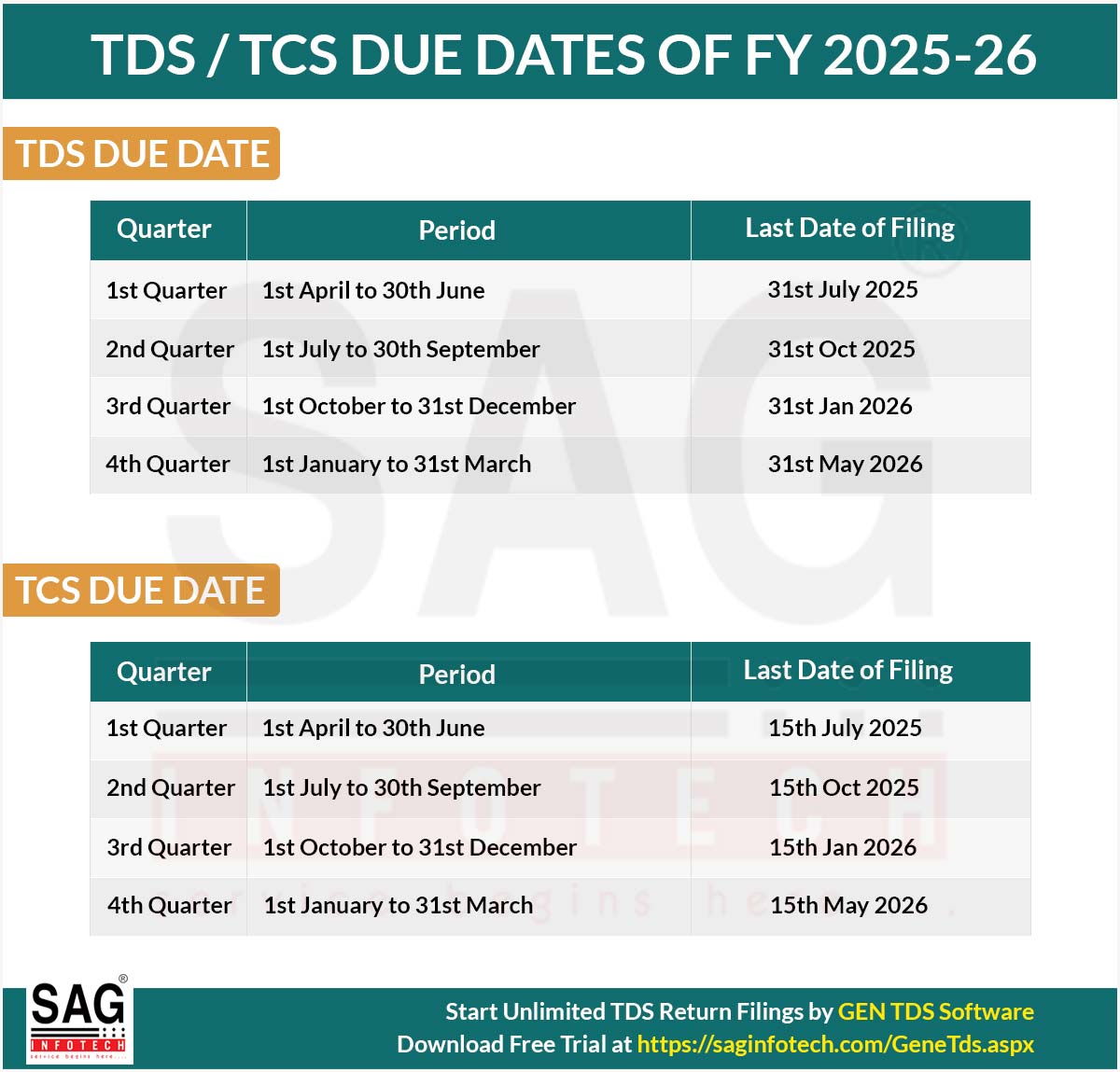

Source: https://blog.saginfotech.com/due-dates-of-e-filing-of-tds-or-tcs-return

Yes property taxes you pay in 2018 and future years will remain deductible. Or does it have to wait for my 2018 tax return. You can deduct up to 10000 or 5000 if married filing separately of state and local taxes including personal property taxes. Property tax is the amount that is paid by the landowner to the municipal corporation or the local government for hisher area.

Source: https://housing.com/news/section-80eea-deduction-on-home-loan-interest-for-affordable-housing/

Taxpayers who prepay their 2018-2019 property taxes in 2017 will not be allowed to deduct the prepayment on their federal tax returns because the county will not assess the property tax for the 2018-2019 tax year until July 1 2018. This includes state income taxes as well as real estate property taxes. Its from the 2017 Tax Cuts and Jobs Act and is effective for tax years 2018 through 2028. If you submit your LPT Return using the paper Form LPT1.

Post a Comment for "I Paid My 2022 Home Property Tax In 2017. Can I Deduct It From 2017 Return"